Welcome back to our ongoing analysis of Emergent BioSolutions (NYSE: EBS). As we enter Q4 2024, the company has made significant progress in its transformation efforts, completing several strategic divestitures and successfully refinancing its debt. These developments, combined with strong operational execution and a robust pipeline of opportunities, have solidified my confidence in EBS’s long-term growth potential. Based on my analysis of Q3 2024 results and the company’s outlook, I am reiterating my $30 price target for August 2025 and maintaining a Strong Buy rating for the stock. I anticipate an EPS of $0.31 for Q4 and an EBITDA guidance of $225M for 2025.

As always, this analysis represents my personal views and research – please conduct your own due diligence before making any investment decisions.

Product Portfolio

The company operates in three main segments:

- Commercial Products

- Medical Countermeasure (MCM) Products

- Services (Bioservices)

Let’s take a closer look at Emergent’s product portfolio across its three main segments:

1. Commercial Products Segment

- NARCAN® (naloxone HCl) Nasal Spray: This is Emergent’s flagship commercial product. It’s approved by both the FDA and Health Canada for the emergency treatment of known or suspected opioid overdose. The recent FDA approval for over-the-counter use could potentially expand its market reach significantly.

2. Medical Countermeasure (MCM) Segment

Anthrax – MCM Products:

- Anthrasil®: The only FDA and Health Canada-licensed polyclonal antibody for treating inhalational anthrax.

- BioThrax®: The only FDA-licensed vaccine for both pre-exposure and post-exposure prophylaxis of anthrax disease.

- CYFENDUS®: Recently approved by the FDA for post-exposure prophylaxis of anthrax. This could be a growth driver for Emergent.

- Raxibacumab: The first fully human monoclonal antibody approved by the FDA for treating and preventing inhalational anthrax.

Smallpox – MCM Products:

- ACAM2000®: The only FDA-licensed single-dose smallpox vaccine for high-risk individuals.

- CNJ-016®: The only FDA and Health Canada-licensed polyclonal antibody for treating complications from smallpox vaccination.

- TEMBEXA®: An oral antiviral approved by the FDA for treating smallpox in all age groups, including neonates.

Other Products:

- BAT®: The only FDA and Health Canada-licensed heptavalent antitoxin for treating symptomatic botulism.

- Ebanga™: A monoclonal antibody for treating Ebola, distributed in partnership with Ridgeback Biotherapeutics.

3. Services Segment (Bioservices – CDMO)

While not a product per se, this segment offers “molecule-to-market” services including:

- Drug substance manufacturing

- Drug product manufacturing (fill/finish services)

- Packaging

- Development services (technology transfer, process, and analytical development)

Competition

This section examines the competitive pressures in EBS’s key markets and explores how industry trends are reshaping the company’s competitive position.

NARCAN

Competition remains intense in the naloxone market, but Emergent has strengthened its competitive position through product differentiation. During Q3 2024 earnings call, management highlighted that NARCAN® volumes grew 7% year-to-date despite price pressure, with pricing now stabilizing since July 2024. The addition of KLOXXADO® 8mg nasal spray through a six-year exclusive commercial rights agreement complements the OTC NARCAN® 4mg offering, creating a comprehensive portfolio that serves both prescription and over-the-counter markets. Under the agreement, Hikma maintains manufacturing responsibilities while Emergent gains commercial control, enabling efficient integration without significant capital investment.

This dual-product strategy allows Emergent to leverage its established NARCANDirect™ distribution network while addressing different market needs. While generic competition has impacted pricing, particularly in the OTC segment, the ability to offer both standard 4mg and high-strength 8mg options positions Emergent as a more complete provider of opioid overdose solutions. Recent CDC data showing the first meaningful decline in overdose deaths since 2018 suggests that expanded naloxone access strategies are working, supporting continued market growth potential.

Medical Countermeasures (MCM)

The Medical Countermeasures (MCM) segment continues to demonstrate strong momentum, with over $500 million in new contract modifications secured in 2024. Management’s focus on diversifying the MCM portfolio is yielding results, particularly with the expansion of ACAM2000’s indication to include mpox treatment and prevention.

The mpox opportunity has grown significantly, as evidenced by the ongoing outbreak across Africa and other regions. The company has taken a leadership role in addressing this public health threat, donating 50,000 doses of ACAM2000 for potential deployment in Central Africa. The company is actively engaging with world health leaders to support the global response, positioning itself to increase supply as needed.

In the anthrax market, EBS maintains its strong position through BioThrax and CYFENDUS, with multiple products serving different prophylaxis and treatment needs. The company has secured substantial contract modifications for its anthrax countermeasures, reflecting continued government commitment to preparedness.

Development programs are also advancing, with a $42 million BARDA contract option for Ebanga development and a new clinical trial evaluating TEMBEXA for mpox treatment in Africa.

The robust Congressional funding environment, with over $2.8 billion allocated across BARDA, Strategic National Stockpile, and Project BioShield programs, provides a strong foundation for continued MCM contract opportunities. This sustainable funding base, combined with expanding international opportunities, particularly in mpox treatment, positions the MCM segment for continued growth.

Properties

Emergent BioSolutions owns and leases the following facilities.

| Location | Use | Approximate square feet |

|---|---|---|

| Lansing | Manufacturing / Office / Lab | 336,000 (Owned) |

| Winnipeg | Manufacturing / Office / Lab | 160,000 (Owned) 15,800 (Leased) |

| Canton | Manufacturing | 122,508 (Owned) 27,000 (Leased) |

| Gaithersburg | Lab / Office / Rental | 173,000 (Owned) 11,547 (Leased) |

| Baltimore (Bayview) | Manufacturing / Office / Lab | 112,000 (Owned) |

| Elkridge | Warehouse | 103,182 (Leased) |

| Rockville | Manufacturing / Office / Warehouse | 84,295 (Owned) |

| San Diego | Office | 18,012 (Leased) |

Debt Structure

As of September 30, 2024, EBS has successfully restructured its debt with two main components.

| Debt Instrument | Amount | Maturity | Interest Rate |

|---|---|---|---|

| New Term Loan | $250 million | August 2029 | Variable: 7.25% (Base Rate Loans) or 8.25% (SOFR Loans) Note: Includes warrants for 2.5M shares |

| Senior Unsecured Notes | $450.0 million | August 15, 2028 | Fixed: 3.875% |

The company also secured a new $100M asset-based revolving credit facility maturing in September 2029, which was undrawn as of September 30, 2024.

This refinancing represents a significant improvement from the previous debt structure, extending maturities and reducing total debt. The company has reduced its gross debt by $167M (19%) and net debt by $206M (27%) compared to year-end 2023. Annual interest expense is expected to be approximately $51M.

The successful refinancing, combined with proceeds from asset sales and settlements, has strengthened EBS’s financial position and removed previous “going concern” language.

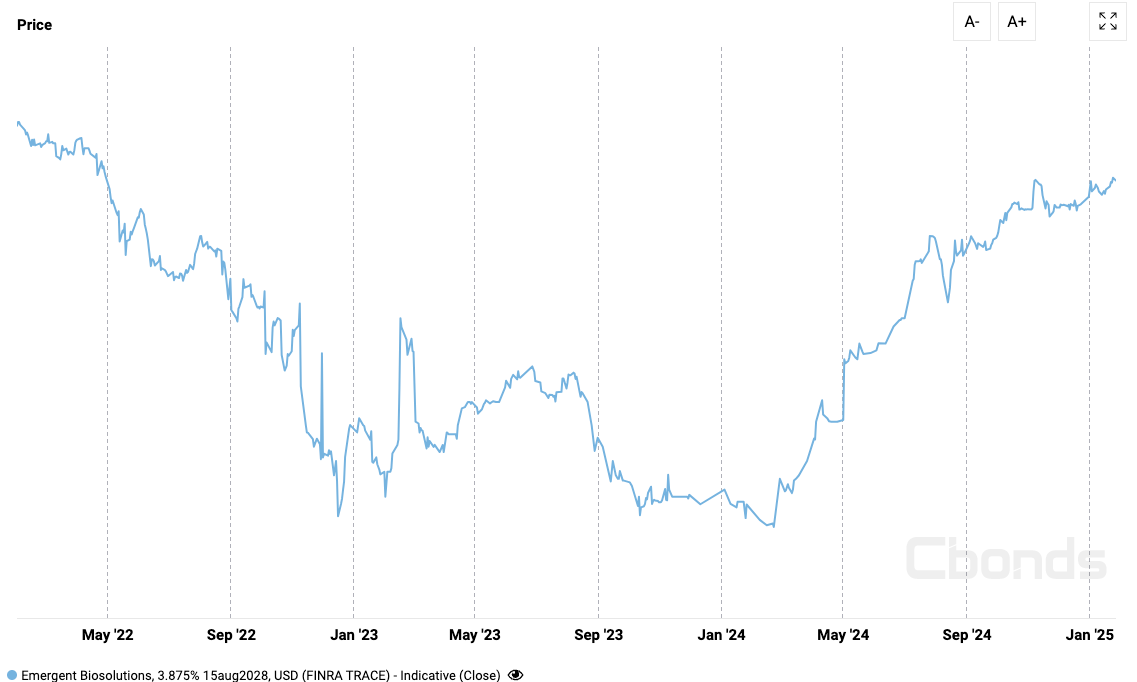

Bond Market Recovery

The bond market, often considered a bellwether for a company’s financial health, has shown a notable recovery in EBS’s bond prices. This upward trend, as illustrated in the attached image, indicates growing confidence among bondholders in the company’s ability to meet its financial obligations. The recovery in bond prices suggests that investors are increasingly optimistic about EBS’s turnaround efforts and its potential to navigate through its current financial straits. The bonds are classified by Moody’s as B3, upgraded from Q2 when they were classified as Caa3.

Leadership Alignment: Joseph Papa’s Stake in EBS’s Recovery

Joseph Papa, Emergent BioSolutions’ new CEO since February 21, 2024, has a compensation package aligned with shareholder interests. His agreement includes:

- 750,000 stock options vesting at $5, $10, and $15 per share, based on a 20-day trading average after 1 year of tenure

- An $8 million incentive if the stock reaches $15 within five years, after 1 year of tenure.

- An annual bonus targeting 130% of base salary, capped at 200%.

This structure ties Papa’s earnings to EBS’s stock performance. If he raises the stock to $15, he gains from his options and performance incentive.

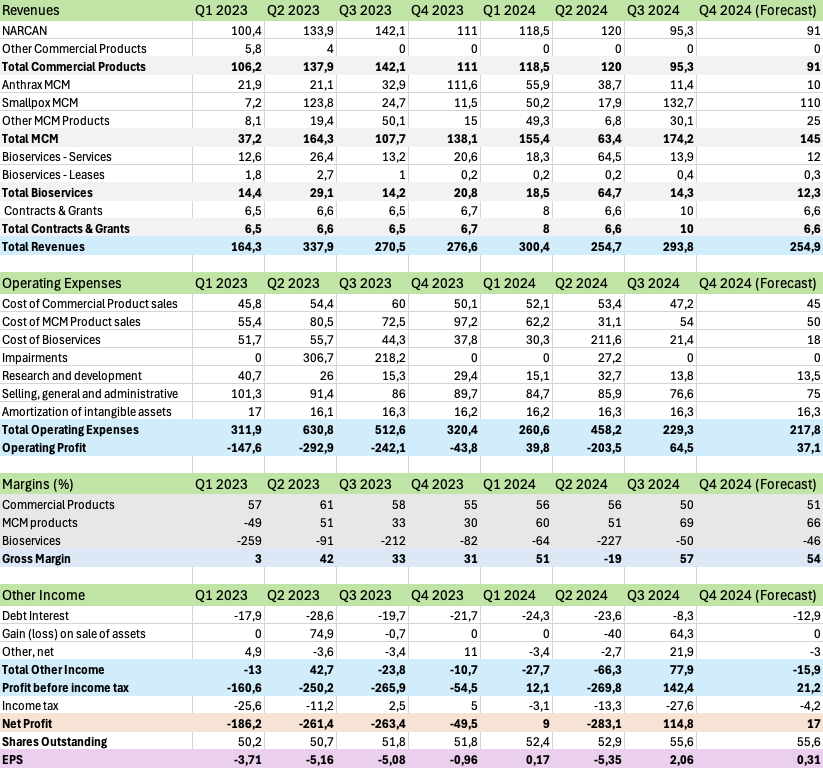

Q3/2024 Analysis

Q3 demonstrated a significant shift in EBS’s business mix and operational execution. The MCM segment emerged as the growth driver, with revenue surging 62% to $174.2M, anchored by strong ACAM2000® performance. NARCAN® sales decreased to $95.3M from $142.1M, primarily due to lower selling prices rather than volume decline – in fact, volumes grew 7% year-to-date. Management noted that pricing has stabilized since July 2024, and with the addition of KLOXXADO® to the portfolio, I expect modest growth in the naloxone franchise at the beginning of 2025.

The quarter highlighted improving operational efficiency, with the total segment-adjusted gross margin expanding to 59% from 38% last year. Cost reduction initiatives are clearly taking hold – SG&A dropped to $76.6M from $86.0M, while R&D spending decreased to $13.8M from $15.3M. The streamlined operational footprint, following facility sales and closures, appears to be delivering the intended benefits.

Financial health improved markedly through several key actions. The company successfully refinanced its debt structure with a new $250M term loan and $100M revolver facility, extending maturities to 2029. Asset sales (RSDL® for $75M, Camden facility for $35M) and the $50M Janssen settlement strengthened the balance sheet. Net debt decreased by $206M (27%) year-to-date, while cash increased to $149.9M from $69.7M in Q2.

Management raised full-year revenue guidance to $1,065M-$1,125M and adjusted EBITDA guidance to $180M-$200M, reflecting increased confidence in the business trajectory. The removal of going concern language and recent credit rating upgrades (Moody’s B3 from Caa1, S&P B- from CCC) suggests the market is recognizing EBS’s improved financial position.

With the stabilization phase largely complete, evidenced by debt reduction, facility rationalization, and improved profitability, management appears ready to focus on strategic growth opportunities. The strong performance in MCM products, combined with the recent $500M in contract modifications and awards, provides a solid foundation for this next phase.

Expected Future Events

- Possible high-value manufacturing opportunities for Bayview facility (e.g., GLP-1 drugs)

- Further development and contract opportunities for TEMBEXA and Ebanga:

- TEMBEXA clinical trial for mpox treatment in Africa through PANTHER/Africa CDC

- Recently announced $42M BARDA contract for Ebanga development

- Expanded international sales of ACAM2000 for mpox:

- Building on 50,000 dose donation to Africa

- Leveraging new FDA approval for mpox indication

- Potential divestiture of Rockville facility

- Congressional funding for FY 2024 maintains focus on high-risk threats through substantial allocations to key programs: $1.015B for Biomedical Advanced Research and Development Authority (BARDA), $980M for Strategic National Stockpile (SNS), and $825 million for Project BioShield Special Reserve Fund (SRF), indicating continued prioritization of biodefense and public health preparedness initiatives.

- Remaining milestone payments from Bavarian Nordic:

- $30M already triggered in Q3 by CHIKV VLP regulatory progress ($10M EMA + $20M FDA)

- Up to $50M in additional potential payments from the original $80M milestone package, a part of this $50M should be received on Q1 2025 along with the chikungunya approval on the 14th of February 2025

- Earn-out payments of up to $30M based on 2026 Vaxchora/Vivotif sales performance

- Granting 500,000 to 750,000 shares to the CEO, scheduled to vest after March 3, 2025.

- $5M milestone upon achievement of a milestone related to the sourcing of a certain component of RSDL®

- Potential collaboration with Milestone Pharmaceuticals for the distribution of Etripamil nasal spray expecting FDA approval by 27 March 2025.

- Results of Africa CDC-Led MpOx Therapeutic Study by the end of Q1

Q4/2024 Forecast

Based on the Q3 2024 earnings call and 10-Q, I am forecasting Q4 2024 to show continued operational improvements and profitability, with expected revenue of $254.9 million and adjusted EBITDA of around $50 million.

For NARCAN, I expect Q4 revenue of $91 million, a modest decline from Q3’s $95.3 million. This forecast reflects the stabilizing pricing environment discussed on the earnings call, along with management’s more conservative guidance for Commercial Products. While volume growth remains strong at 7% year-to-date, the business faces ongoing competitive pressures that warrant a measured outlook.

The MCM Products segment should deliver approximately $145 million in Q4 revenue. This includes an estimated $110 million from Smallpox MCM deliveries, which are part of the recently announced $400 million in contract modifications. I anticipate Anthrax MCM revenue will decrease to $10 million due to delivery timing, while other MCM products should contribute about $25 million to the quarter.

Services revenue is expected to reach $12.3 million in Q4, lower than Q3 primarily due to the full quarter impact of the Camden facility sale.

Operating expenses should continue to decrease as the company realizes the full benefit of its cost savings initiatives. The completion of facility closures and workforce reductions, combined with normalized SG&A expenses without one-time charges, should drive improved profitability.

For Q4, I project earnings per share of $0.31, based on 55.6 million shares outstanding (including the impact of new equity issuance), a tax rate of approximately 20% reflecting the jurisdictional mix, and interest expense of $12.9 million under the new debt structure. This forecast aligns with management’s updated 2024 guidance and reflects the company’s progress in executing its turnaround strategy.

Rating and Price Target

Based on Q3 2024 results and outlook, I maintain the $30 price target for August 2025 that I initially set on the 15th of August 2024 and a Strong Buy rating.

The strong Q3 performance, delivering $105 million in adjusted EBITDA at a 36% margin, demonstrates the company’s improving operational efficiency. The successful refinancing of debt with extensions to 2029 and removal of the going concern qualification mark critical milestones in financial rehabilitation.

The business fundamentals are also showing strength, with over $500 million in new MCM contract modifications secured and NARCAN volumes growing 7% year to date despite competitive pressures. Management’s confidence is reflected in their decision to raise both revenue and EBITDA guidance for FY2024.

The $30 target price represents approximately 8x projected 2025 EBITDA of $225 million or higher, which I believe is achievable as the company realizes the full benefit of its $130 million annual cost savings initiatives and growth strategies gain traction. The potential for further MCM contract wins is enhanced by the strengthened balance sheet, while NARCAN presents meaningful growth opportunities through workplace safety programs and international expansion. The improved operating margins from completed cost reduction programs should provide sustainable earnings power going forward.

The next phase of value creation could come from strategic asset monetization and targeted business development activities. Of particular interest is the Bayview facility, which CEO Joe Papa described as “extraordinary” and “state of the art” during the earnings call. Given its sophisticated capabilities for drug substance manufacturing, this facility could potentially be utilized for the production of in-demand therapeutics like GLP-1 drugs (e.g., Ozempic), though management has not specifically confirmed such plans. With the heavy lifting of financial stabilization now complete, management can focus on driving profitable growth and expanding the company’s role in protecting public health while potentially exploring such high-value manufacturing opportunities.

Disclosure & Acknowledgement

EBS represents a significant portion of my investment portfolio, reflecting both my conviction in the company’s turnaround potential and my tolerance for the associated risks. This substantial position naturally influences my analysis, and readers should consider this potential bias when evaluating my perspectives.

I continue to be grateful for the thoughtful discussions and diverse viewpoints shared by several members of the investment community, particularly @WinstonSmith33, @ComradeKomisar, and @NRG8 on Stocktwits. Their critical analysis and willingness to challenge assumptions have strengthened my understanding of both the opportunities and risks facing Emergent BioSolutions.

Thank you for engaging with my research. I’m committed to providing detailed quarterly analysis of EBS and other companies I cover, made possible by your comments and newsletter subscriptions. I aim to deliver thorough, objective analysis while being transparent about my positions and potential biases. Whether you comment, subscribe to my newsletter, or both, I appreciate you taking the time to review my work.

Disclaimer: This analysis represents my personal views and should not be considered financial advice. Always conduct your own due diligence and consult with financial professionals before making investment decisions.