Hey there, fellow value investors! It’s time to dive into one of the companies I’ve been keeping a close eye on since the beginning of the year: Emergent BioSolutions (NYSE: EBS). As always, I want to remind you that I’m just sharing my thoughts, so please do your own research before making any investment decisions. Emergent BioSolutions is a global life sciences company that’s been on my radar for a while now. They’re in the business of providing solutions for public health threats, which, as we’ve all seen in recent years, is an increasingly important field.

Product Portfolio

The company operates in three main segments:

- Commercial Products

- Medical Countermeasure (MCM) Products

- Services (Bioservices)

Let’s take a closer look at Emergent’s product portfolio across its three main segments:

1. Commercial Products Segment

- NARCAN® (naloxone HCl) Nasal Spray: This is Emergent’s flagship commercial product. It’s approved by both the FDA and Health Canada for the emergency treatment of known or suspected opioid overdose. The recent FDA approval for over-the-counter use could potentially expand its market reach significantly.

2. Medical Countermeasure (MCM) Segment

Anthrax – MCM Products:

- Anthrasil®: The only FDA and Health Canada-licensed polyclonal antibody for treating inhalational anthrax.

- BioThrax®: The only FDA-licensed vaccine for both pre-exposure and post-exposure prophylaxis of anthrax disease.

- CYFENDUS®: Recently approved by the FDA for post-exposure prophylaxis of anthrax. This could be a growth driver for Emergent.

- Raxibacumab: The first fully human monoclonal antibody approved by the FDA for treating and preventing inhalational anthrax.

Smallpox – MCM Products:

- ACAM2000®: The only FDA-licensed single-dose smallpox vaccine for high-risk individuals.

- CNJ-016®: The only FDA and Health Canada-licensed polyclonal antibody for treating complications from smallpox vaccination.

- TEMBEXA®: An oral antiviral approved by the FDA for treating smallpox in all age groups, including neonates.

Other Products:

- BAT®: The only FDA and Health Canada-licensed heptavalent antitoxin for treating symptomatic botulism.

- Ebanga™: A monoclonal antibody for treating Ebola, distributed in partnership with Ridgeback Biotherapeutics.

3. Services Segment (Bioservices – CDMO)

While not a product per se, this segment offers “molecule-to-market” services including:

- Drug substance manufacturing

- Drug product manufacturing (fill/finish services)

- Packaging

- Development services (technology transfer, process, and analytical development)

Competition

Emergent BioSolutions competes with established pharma giants and biotech startups. Competitive dynamics vary significantly across product lines, influenced by government contracts, regulatory changes, and shifting public health priorities. This section examines the competitive pressures in EBS’s key markets and explores how industry trends are reshaping the company’s competitive position.

NARCAN Competition and Market Dynamics: A Nuanced Outlook

Recent developments have changed the landscape for EBS’s NARCAN (naloxone HCl) nasal spray. While competitive pressures have intensified, there’s also potential for market expansion. The entry of generic over-the-counter (OTC) alternatives, including offerings from Teva, Amneal and Walgreens, has intensified competition. This, coupled with government initiatives, is driving prices down and putting pressure on margins. However, the market is simultaneously expanding due to nationwide opioid settlements totaling over $40 billion, according to the National Oppiod Settlement, the settlement amount is compiled in the table below. With at least 85% of these funds earmarked for opioid epidemic abatement, including increased naloxone distribution, the overall market size can grow substantially. This creates a potential trade-off between lower prices and higher volumes.

| Company/Group | Settlement Amount | Payment Period |

|---|---|---|

| Distributors (McKesson, Cardinal Health, AmerisourceBergen) | Up to $21 billion | 18 years |

| Johnson & Johnson | Up to $5 billion | Up to 9 years |

| Teva | Up to $3.34 billion + $1.2 billion in generic naloxone (or $240 million cash) | 13 years (cash), 10 years (naloxone) |

| Allergan | Up to $2.02 billion | 7 years |

| CVS | Up to $4.90 billion | 10 years |

| Walgreens | Up to $5.52 billion | 15 years |

| Walmart | Up to $2.74 billion | Within 6 years |

MCM Segment: Specialized Products in a Government-Driven Market

The MCM segment of Emergent BioSolutions is primarily shaped by government contracts.

In the anthrax market, EBS holds a strong position with multiple products. BioThrax, as the only FDA-licensed vaccine for both pre and post-exposure prophylaxis, faces limited direct competition. The recent approval of CYFENDUS for post-exposure prophylaxis could drive growth, potentially competing with BioThrax in certain scenarios. Anthrasil and Raxibacumab, being the only approved treatments of their kind, also face minimal direct competition.

For smallpox products, ACAM2000’s position as the only FDA-licensed single-dose vaccine for high-risk individuals gives it a competitive edge. CNJ-016 and TEMBEXA also enjoy unique positions in their respective niches.

BAT and Ebanga similarly benefit from their status as the only approved products in their categories.

The primary competition in the MCM segment often comes from:

- Other pharmaceutical companies developing similar products

- Alternative technologies or approaches to addressing the same threats

- Companies competing for the same government contracts

EBS’s main challenge in this segment is maintaining its position as the preferred supplier for government stockpiles and securing new contracts. The company must continually innovate and demonstrate the superiority of its products to retain its market position.

Properties

Emergent BioSolutions owns and leases approximately 1.4 million square feet of building space across 16 North American and European locations. These properties include development, manufacturing, laboratories, fill/finish facility services, offices, and warehouse space.

Here’s a breakdown of their principal locations:

| Location | Use | Approximate square feet | Notes |

|---|---|---|---|

| Lansing | Manufacturing / Office / Lab | 336,000 (Owned) | |

| Winnipeg | Manufacturing / Office / Lab | 160,000 (Owned) 15,800 (Leased) | |

| Gaithersburg | Lab / Office / Rental | 173,000 (Owned) 11,547 (Leased) | |

| Empty building. Sold for 7M. | |||

| Baltimore (Bayview) | Manufacturing / Office / Lab | 112,000 (Owned) | |

| Elkridge | Warehouse | 103,182 (Leased) | |

41,000 (Leased) | Sold for 30M and 350 employees relocated in Q3 2024. (Link 1, Link 2) | ||

| Rockville | Manufacturing / Office / Warehouse | 84,295 (Owned) | |

| San Diego | Office | 18,012 (Leased) |

The Debt Problem

Emergent BioSolutions continues to navigate a challenging financial landscape, but recent developments suggest a glimmer of hope amidst the ongoing debt concerns. While the company’s balance sheet remains under pressure, with substantial outstanding debt on its credit facilities and limited cash reserves, there are signs that market sentiment may be shifting.

Debt Structure as of June 30, 2024

As of June 30, 2024, the company had $222.7 million outstanding on its Revolving Credit Facility and $190.3 million on its Term Loan Facility, both of which mature in May 2025. Additionally, EBS has $450 million in 3.875% Senior Unsecured Notes due in 2028. With only $69.7 million in cash and cash equivalents as of the same date. The total debt amount to $863 million as of June 30, 2024.

| Debt Instrument | Amount Outstanding | Maturity | Interest Rate |

|---|---|---|---|

| Revolving Credit Facility | $222.7 million | May 2025 | Variable: 7.00% (Base Rate Loans) or 8.50% (SOFR/RFR/Eurocurrency Loans) |

| Term Loan Facility | $190.3 million | May 2025 | Variable: 7.00% (Base Rate Loans) or 8.50% (SOFR/RFR/Eurocurrency Loans) |

| 3.875% Senior Unsecured Notes | $450.0 million | August 15, 2028 | Fixed: 3.875% |

| Other debt | $0.8 million | Not specified | Not specified |

Based on the SOFR rate of 5.33% as of August 29, 2024, EBS is facing an interest rate of approximately 13.83% on its variable rate debt, which currently amounts to $413 million. This translates to about $57 million in annual interest payments for the current part of its debt. When including the $450 million in senior unsecured notes at 3.875%, the company’s total annual interest burden rises to approximately $75 million.

New Debt Structure as of September 3, 2024

| Debt Instrument | Amount | Maturity | Interest Rate |

|---|---|---|---|

| New Term Loan | Up to $250 million | August 2029 | Variable: 7.25% (Base Rate Loans) or 8.25% (SOFR Loans) |

| 3.875% Senior Unsecured Notes | $450.0 million | August 15, 2028 | Fixed: 3.875% |

On September 3, Emergent BioSolutions announced the successful refinance of its current debt portion. The New Term Loan replaces both the Revolving Credit Facility ($222.7 million) and Term Loan Facility ($190.3 million) that were set to mature in May 2025. This restructuring extends the maturity date by over four years, providing EBS with much-needed breathing room. This also reduces the total debt by $163 million. This new deal should be enough to remove the “going concern” language from the next 10 Q report.

Interest Expense Analysis (assuming the company borrows $250 million)

- Previous annual interest expense: ~$75 million

- Estimated new annual interest expense:

- Assuming a 13.58% interest rate (SOFR 5.33% + 8.25% margin) interest rate on the New Term Loan: $33.95 million

- 3.875% Senior Unsecured Notes: $17.4 million

- Total estimated new annual interest: $51.35 million

Potential annual savings: ~$23.65 million

Interest savings are substantial, this assumes that the company will borrow the 250 million from the new term loan. This may not come into effect as the company predicted to reduce its total debt this year by $200 million. By borrowing the total amount the company is reducing its debt by only $163 million. Let’s make a prediction where the company reduces its total debt by $200 million and so uses $213 million from the term loan.

Interest Expense Analysis (assuming the company borrows $213 million)

- Previous annual interest expense: ~$75 million

- Estimated new annual interest expense:

- Assuming a 13.58% interest rate (SOFR 5.33% + 8.25% margin) interest rate on $213 million from the New Term Loan: $28.92 million

- 3.875% Senior Unsecured Notes: $17.4 million

- Total estimated new annual interest: $46.32 million

Potential annual savings: ~$28.68 million

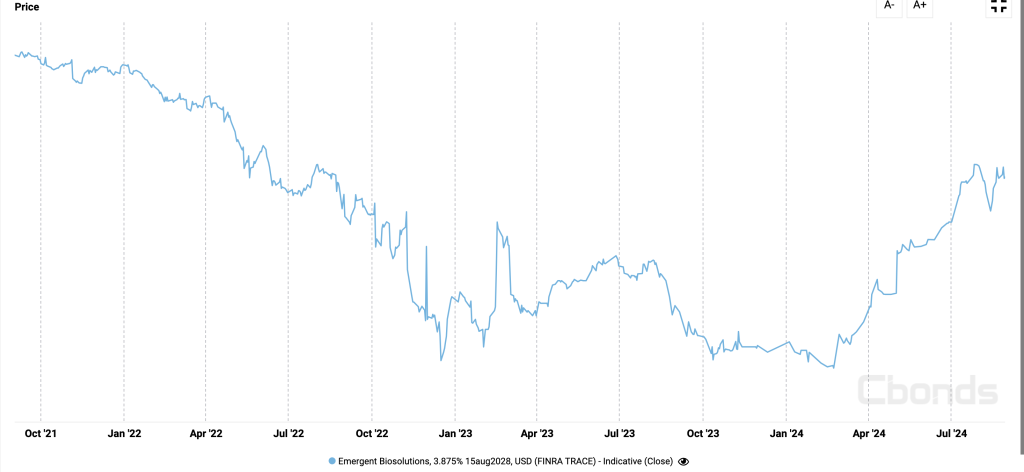

Bond Market Recovery

The bond market, often considered a bellwether for a company’s financial health, has shown a notable recovery in EBS’s bond prices. This upward trend, as illustrated in the attached image, indicates growing confidence among bondholders in the company’s ability to meet its financial obligations. The recovery in bond prices suggests that investors are increasingly optimistic about EBS’s turnaround efforts and its potential to navigate through its current financial straits. The bonds are classified by Moody’s as Caa3 (speculative grade).

The company’s options for raising capital remain constrained. EBS had previously established an “at-the-market” (ATM) equity offering program with a $150 million capacity. As of June 30, 2024, $140.9 million of this capacity remains available. Yet, the company faces significant restrictions on its ability to utilize this program. EBS’s Registration Statement on Form S-3 is set to expire on August 9, 2024, and due to a delayed filing of its Q3 2023 quarterly report, the company will not be eligible to file a new Registration Statement until 2025. This effectively puts a hold on EBS’s ability to raise equity capital through the ATM program until a new Registration Statement becomes effective.

This limitation on equity issuance could be viewed positively by existing shareholders, as it prevents immediate dilution of their stakes.

Building on these challenges, recent developments suggest EBS is making tangible progress in addressing its debt issues. The company expects to reduce its debt by approximately $200 million this year, a significant step towards financial stability. This reduction is being achieved through a series of strategic moves, including asset sales and settlement payments.

EBS is likely to satisfy and potentially remove the $85 million junior debt covenant through these actions. The sale of RSDL to SERB Pharmaceuticals ($75 million), the sale of the Camden facility to Bora Pharmaceuticals ($30 million), the sale of an underutilized warehouse ($7 million), the Janssen contract dispute settlement ($50 million), and an anticipated Bavarian Nordic milestone payment ($10 million) collectively amounting to $172 million exceed the covenant requirement.

Market sentiment appears to be improving, as evidenced by the recovery in EBS’s bond prices. If historical correlations between bond and stock prices hold, this could imply a potential stock price in the $30-$35 range, a significant increase from current levels.

Operationally, EBS has taken drastic measures, reducing its workforce by about 50% since January 2024, with expected annual savings of approximately $110 million. These cost-cutting measures, combined with raised revenue and adjusted EBITDA guidance for 2024, suggest the company is stabilizing its operations alongside its debt reduction efforts.

Leadership Alignment: Joseph Papa’s Stake in EBS’s Recovery

Joseph Papa, Emergent BioSolutions’ new CEO since February 21, 2024, has a compensation package aligned with shareholder interests. His agreement includes:

- 750,000 stock options vesting at $5, $10, and $15 per share, based on a 20-day trading average.

- An $8 million incentive if the stock reaches $15 within five years.

- An annual bonus targeting 130% of base salary, capped at 200%.

This structure ties Papa’s earnings to EBS’s stock performance. If he raises the stock to $15, he gains from his options and performance incentive.

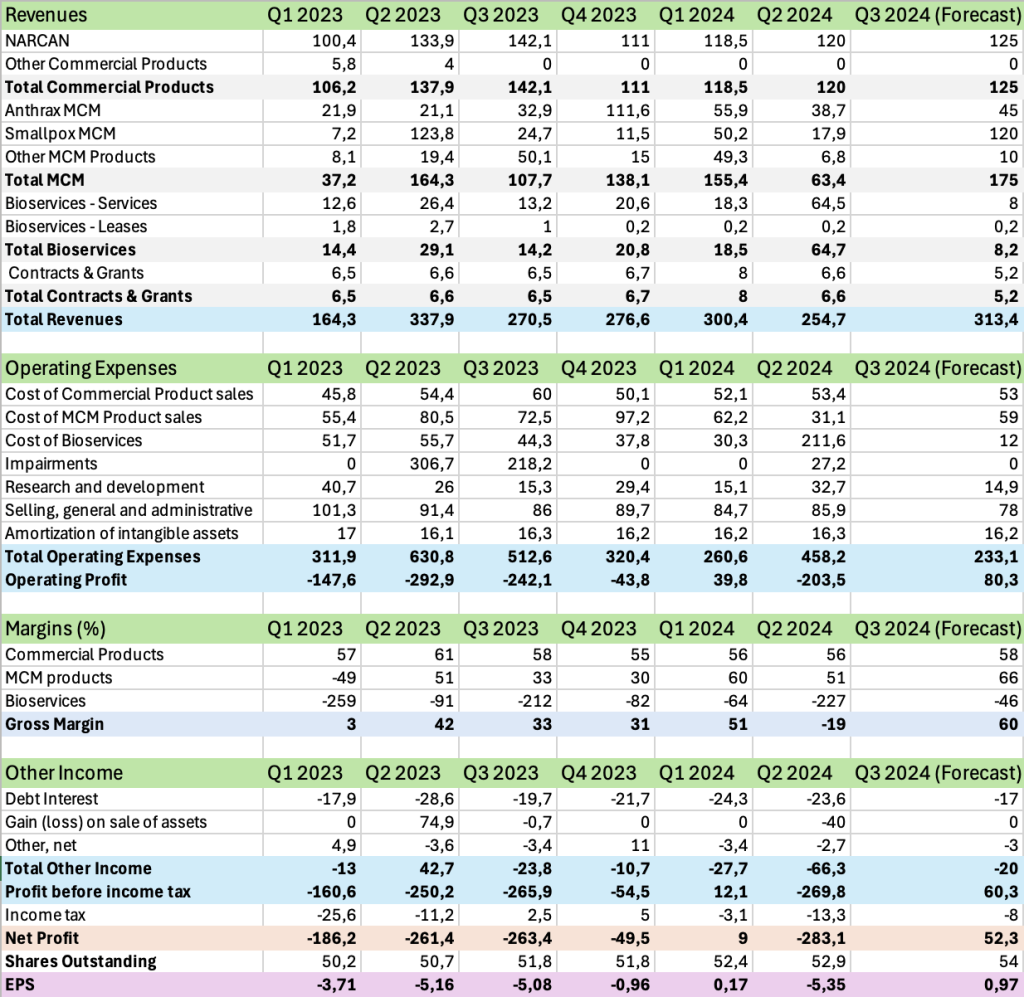

Q2/2024 Analysis

Emergent BioSolutions reported a total revenue of $330.0 million in Q2 2024, a significant increase from $185.9 million in Q2 2023. However, this revenue growth was overshadowed by a substantial cost rise, particularly in the Bioservices segment.

The cost of product sales stood at $119.8 million, but the most notable change was in the cost of Bioservices. This figure jumped from $30.3 million in Q1 2024 to $211.6 million in Q2 2024, an increase of $181.3 million. A significant portion of this increase, $160.2 million ($110.2 million + $50 million), was attributed to a settlement charge with Janssen Pharmaceuticals. Restructuring costs accounted for only for a $0.4 million expense in the services segment.

However, even after accounting for these one-time charges, an unexplained increase of $20.9 million in Bioservices costs remains. These costs should not be related to the sale of the Camden facility, as those were one-time charges recorded as “Gain (loss) on sale of assets.” They are also unrelated to restructuring costs, which totaled $17.1 million, with only $0.4 million attributed to the services segment.

Tax Situation Analysis

EBS’s tax situation in Q2 2024 presents an unusual scenario. Despite reporting a loss before income taxes of $269.8 million, the company recorded an income tax provision (expense) of $13.3 million, resulting in an effective tax rate of (6)% for the six months ended June 30, 2024. Additionally, EBS reported a tax effect of $67.9 million related to one-time charges and adjustments.

To put this in perspective, let’s compare EBS’s approach to that of Walgreens Boots Alliance (WBA) in their Q2 2024 results. WBA reported a GAAP net loss of $5,908 million, primarily due to a $12,369 million impairment of goodwill and other significant one-time charges. However, their tax treatment stands in contrast to EBS’s approach.

WBA recorded a tax effect of $595 million related to their adjustments, but more importantly, they reported a total tax benefit of $782 million. This means that not only did WBA not pay taxes on their reported loss, but they also received a substantial tax benefit. This approach aligns more closely with what one would expect for a company reporting significant losses and one-time charges.

The contrast between EBS and WBA’s tax treatments is notable. While WBA recognized a substantial tax benefit, EBS has recorded a tax expense despite significant losses and one-time charges. Moreover, EBS’s approach suggests that without the one-time charges, the company would have paid both the tax effect ($67.9 million) and the actual tax paid ($13.3 million), totaling $81.2 million in taxes. This figure differs from EBS’s historical tax expenses and seems unexpected given their current financial situation, note also that no valuation allowance was reported by the company this quarter.

This points to a potentially very conservative accounting approach by EBS. The company may be adopting a strategy of presenting more challenging financial results in the current quarter. Such an approach could lead to exaggerated negative results in the short term, potentially setting the stage for more positive outcomes in future quarters, particularly towards the year-end. This could create a situation where future quarters appear more favorable by comparison, especially if the company realizes tax benefits or reverses some of the conservative estimates in subsequent periods.

Although EBS’s tax treatment is complex, due to factors such as a mix of profits and losses across various jurisdictions, non-deductible expenses, timing differences between tax and accounting recognition, and minimum tax requirements in certain regions—the reported tax effect of $67.9 million compared to the tax paid of $13.3 million seems significantly off.

This situation highlights the importance of looking beyond the reported figures to assess EBS’s true financial position and performance. The company’s conservative accounting approach may be creating a more pessimistic view of its current financial health than is actually the case. As such, future financial reports from EBS may reveal a more positive picture as these conservative estimates potentially unwind or reverse. Considering this, let’s calculate our own adjusted EPS from the adjusted EBITDA.

Adjusted EPS from adjusted EBITDA

Turning to the company’s operational performance, EBS reported an adjusted EBITDA of -$10 million. To gain a clearer picture of the company’s performance, we can calculate an adjusted EPS figure based on this EBITDA. Starting with the -$10 million adjusted EBITDA, we subtract the real depreciation and amortization of $28.5 million, then subtract the interest expense of $29.2 million and the income tax provision of $13.3 million. This calculation yields an adjusted earnings of -$81 million.

With 51.3 million shares outstanding, the adjusted EPS comes to -$1.57. This figure excludes the tax effect related to one-time charges and considers only the real amortization, depreciation, interest, and taxes paid. The negative adjusted EPS underscores the operational challenges EBS is currently facing, even when accounting for various adjustments.

Note that this calculation does not include the unexplained $20.9 million Bioservices costs. If we adjust for that value we get a loss of $60.1 million with an adjusted EPS of -$1.17 which contrasts with the -$2.32 reported by the company.

Expected Future Events

- Receipt of a $10 million development milestone payment from Bavarian Nordic in the third quarter of 2024 related to the sale of the Travel Health Business.

- Anticipated debt reduction of over $200 million by the end of 2024.

- Potential future procurement contracts for medical countermeasures (MCMs) with the U.S. government in the second half of 2024.

- Potential receipt of an additional $20 million related to the Bavarian Nordic milestone by year-end 2024.

- Further development and potential procurement options for TEMBEXA and Ebanga in the coming years.

- International sales of ACAM2000 to address the MPOX outbreak.

- Possible additional asset sales or divestitures as part of the company’s restructuring efforts.

- Congressional funding for FY 2024 maintains focus on high-risk threats through substantial allocations to key programs: $1.015B for Biomedical Advanced Research and Development Authority (BARDA), $980M for Strategic National Stockpile (SNS), and $825 million for Project BioShield Special Reserve Fund (SRF), indicating continued prioritization of biodefense and public health preparedness initiatives.

- Potential receipt of up to $50 million in additional deferred payments from Bavarian Nordic for the travel health business sale, likely spread across 2024 and 2025. This is on top of the previously mentioned $10 million and $20 million milestone payments (points 1 and 4), bringing the total deferred consideration to approximately $80 million.

Q3/2024 Forecast

I am forecasting an updated and improved guidance for Q3, with the new adjusted EBITDA for the full year projected to be between $150 million and $200 million. This is an increase from the company’s Q2 forecast of $140 million to $180 million.

The revision is primarily due to the exclusion of the Camden facility sale from the previous forecast. The facility had been contributing $15 million to $20 million in revenue but was also generating a negative adjusted EBITDA of $5 million to $10 million. Papa mentioned this in the Q2 conference call.

We’re forecasting adjusted EBITDA of $140 million to $180 million. The increase at the midpoint reflects the improved visibility of our MCM revenues as well as our continued focus on operating expenses. It’s important to note that this guidance reflects the sale of RSDL, which we completed last week, but does not yet reflect the impact of the upcoming Camden facility sale, as that transaction has not yet closed. Having said that, there is currently $15 million to $20 million of revenue and negative $5 million to $10 million of adjusted EBITDA related to Camden in our forecast for the second half of the year. – Joseph Papa

The Camden sale should decrease the FY revenue by $20 million, these are reductions in the services segment. However, this should be offset by new ACAM2000 orders to combat the mpox outbreak. As a result, I expect total revenue to remain flat compared to the previous forecast, while EBITDA should improve due to the Camden facility’s previous operating losses.

Additionally, the operating margin is expected to increase in Q3 due to the layoffs of 350 employees in Q2. Since the severance costs were already incurred in Q2, the operating margin should improve in the upcoming quarter. The table below shows my detailed predictions for Q3 2024, these contrast with a -$0.21 (loss) expected by professional analysts. The total shares outstanding should be around 54 million due to a slight dilution ($10 million) in the new debt agreement. This does not account for the outstanding warrants that originated from the new debt agreement as they may never be exercised.

Rating and Price Target

Based on all the considerations above, I give Emergent BioSolutions a price target of $30 for August 2025. I rate it a strong buy. It seems to me that the stabilize/turnaround phase is near the end and we are entering the profitable growth phase.

This price target reflects the potential for EBS to successfully overcome its current challenges, capitalize on its debt reduction efforts, and benefit from the leadership incentives under Joseph Papa. It also accounts for an expected $10-$20 million improvement in EBITDA guidance, raising the new FY2024 EBITDA forecast to a range of $150 to $200 million.

The strong buy rating is based on the significant upside potential from current price levels, assuming EBS continues to execute its turnaround strategy effectively, meets its financial goals, and avoids major setbacks. However, investors should remain aware that risks and uncertainties persist, and achieving this target depends on the company’s ability to overcome its financial hurdles and return to growth.

Disclosure & Acknowledgement

I hold a position in EBS. In fact, EBS comprises the majority of my portfolio. This disclosure is made to ensure transparency and to acknowledge potential bias in the presented viewpoints.

I would like to express my sincere gratitude to @WinstonSmith33, @ComradeKomisar, and @NRG8 from Stocktwits for their valuable insights and productive discussions. Their contributions have significantly enriched this analysis and provided diverse perspectives on Emergent BioSolutions.

If you enjoyed this post, please consider leaving a comment, subscribing to my newsletter so you don’t miss future posts, or becoming a Patreon supporter. Your engagement and support will let me know my content is appreciated and motivate me to continue creating new blog posts every quarter for EBS and other companies I follow. If you really loved the content, feel free to do all of the above!

Very good analysis!

Thanks Alexander and sorry for the late reply! Really appreciate the kind words, they keep me motivated keep sharing detailed analyses like this one.

Best,

Daniel

Very comprehensive. I’m retired and a very small investor but do have some stock in this company and I appreciate your thorough analysis.

Hey Russell!

Thanks for your kind comment.

I’m glad my analysis could help. Really appreciate you taking the time to read through it all!

Best,

Daniel

Top notch analysis !

Greatly appreciated and thankful for your time energy and dedication to giving us a better understanding of exactly where EBS stands.

This is my #2 holding only behind Altimmune (ALT) and I am definitely excited about the future for EBS and the continued guidance of Joe Papa !

He has absolutely set the company back on track in my opinion.

GL in all your trading and thanks again for your dedication.

Hey Bob!

Thanks for the kind words! Totally agree about Papa – his methodical execution of the turnaround plan has been impressive. Really appreciate you reading the analysis, and good luck with both EBS and ALT!

Best,

Daniel